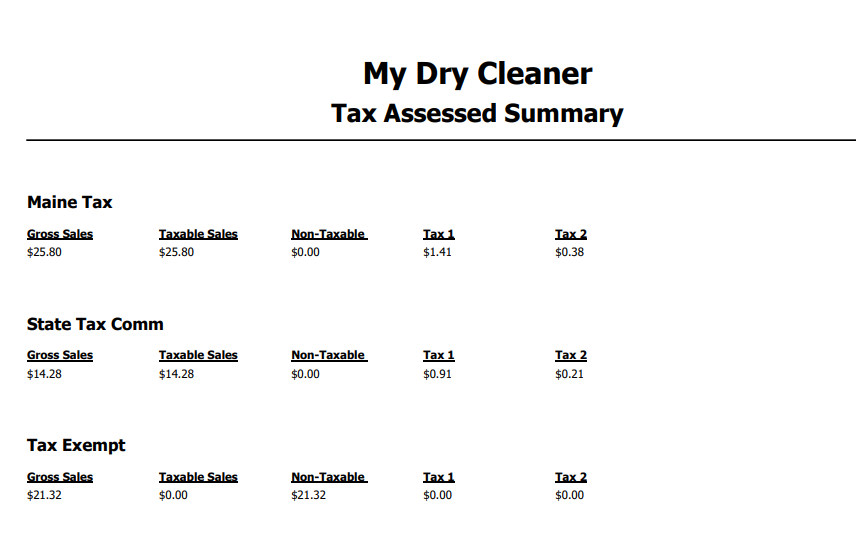

This report shows total sales, taxable sales, non-taxable sales and tax assessed for each tax entity within the date range specified. Negative amounts may appear if an invoice is modified in such a way that the tax goes down. Run the Tax assessed by Tax entity for invoice detail.

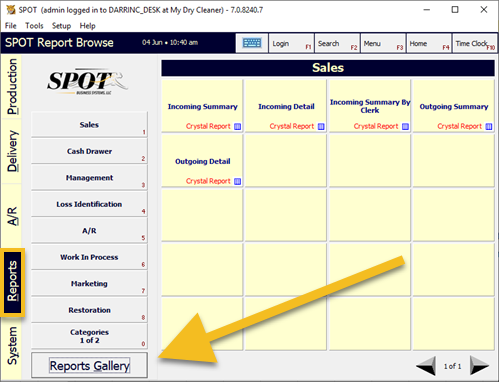

To access the report:

Select the Reports tab then Reports Gallery.

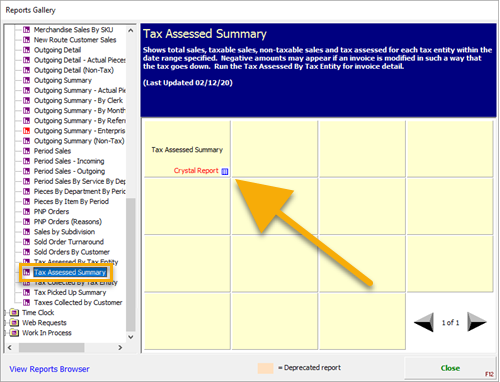

Next expand Sales and select Tax Assessed Summary.

Then select the Tax Assessed Summary Crystal Report tile.

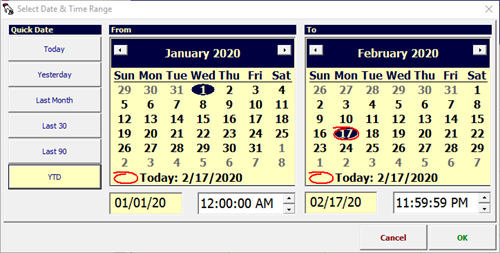

Select your date range.

This report is grouped by tax entity.

The following is the list of columns with a short description.

Gross Sales: This reflects the value of invoices created or modified during the date range selected. Example: If an invoice was created before the date range selected, but an item was added to that invoice during the date range, only the value of the item added would be reflected.

Taxable Sales: Total amount of Gross Sales that was able to be taxed.

Non-Taxable: Total amount of Gross Sales that was NOT able to be taxed.

Tax 1: Total tax assessed minus the secondary rate if used. The secondary rate is primarily used with Canada for provincial taxes.

Tax 2: Total tax for the secondary rate. The secondary rate is primarily used with Canada for provincial taxes.