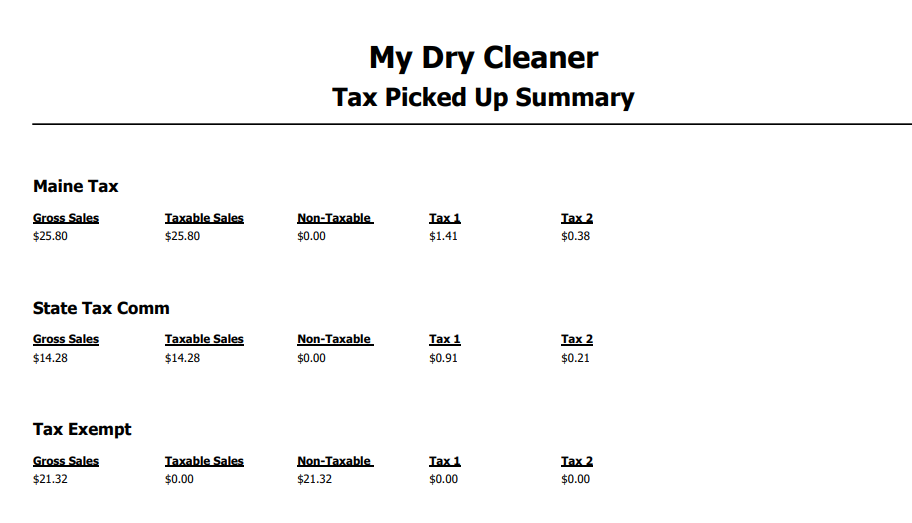

This report shows total sales, taxable sales, non-taxable sales, and tax collected for tax entity within the date range specified. The tax appears on the report when the invoice is closed.

To access the report:

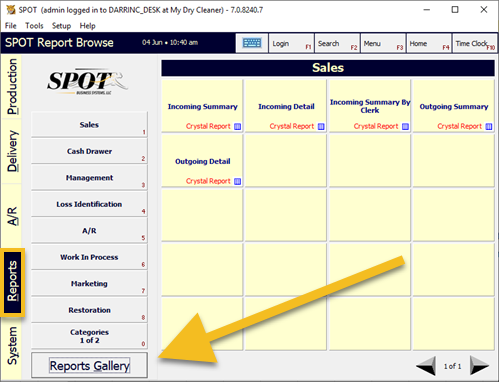

Select the Reports tab, then Reports Gallery.

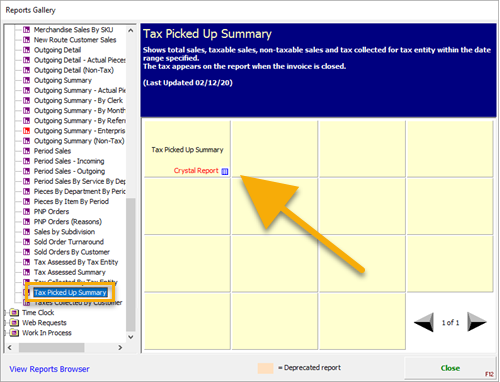

Next, expand Sales and select Tax Picked Up Summary.

Then select the Tax Picked Up Summary Crystal Report tile.

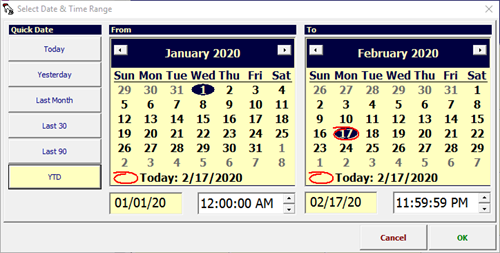

Select your date range.

This report is grouped by tax entity.

The following is the list of columns with a short description.

Gross Sales: This reflects the value of invoices closed during the date range selected.

Taxable Sales: Total amount of Gross Sales that was able to be taxed.

Non-Taxable: Total amount of Gross Sales that was NOT able to be taxed.

Tax 1: Total tax assessed minus the secondary rate if used. The secondary rate is primarily used with Canada for provincial taxes.

Tax 2: Total tax for the secondary rate. The secondary rate is primarily used with Canada for provincial taxes.